Online Purchase Protection Insurance

This privilege applies to Cardholders of the following Credit Cards:

- Krungsri Visa Platinum, Krungsri Mastercard Platinum, Krungsri Visa Doctor Card

- Krungsri JCB Platinum Credit Card

- Siam Takashimaya Visa Credit Card, Siam Takashimaya JCB Credit Card

- AIA Visa Platinum Credit Card

- HomePro Visa Platinum Credit Card

- Krungsri Manchester United Visa Platinum Credit Card

Coverage

- Covering financial loss or damage sustained by Cardholders of Krungsri Platinum credit card, Krungsri JCB Platinum credit card, HomePro VISA Platinum credit card, AIA VISA Platinum credit card, Siam Takashimaya VISA/JCB credit card, and Krungsri Manchester United credit card when making online purchase via internet website (of both domestic and overseas vendors) and making payment online via payment gateway using one of such credit card and suffering from a fraudulent act of the vendor resulting in the purchased goods not delivered or the purchased goods delivered with shortage or a wrong product being delivered.

- Covering loss or damage sustained by the Cardholders when making online purchase via internet website (of both domestic and overseas vendors) and making payment online via payment gateway from theft, robbery, gang-robbery or an accident from external cause which is not excluded by the insurance policy occurring while the goods are being transported to the final destination of delivery. Coverage (2) is subject to a Deductible of 10% or minimum 3,000 Baht per goods item per occurrence.

Limit of Coverage

Not exceeding 5,000 Baht per anyone occurrence and maximum limit not exceeding 6,000 Baht per one calendar year per card. No limit on the number of claims per year subject to the total maximum limit inclusive for both Coverage (1) and (2) per card per year.

(Coverage is applicable for purchase payment of at minimum 2,500 Baht per sale slip)

Exclusions for Coverage (1)

- Any Loss or damage which is recoverable under a product warranty of the manufacturer, vendor or carrier or which is covered by other insurance company or any other entity.

- Any loss or damage occurring from the purchase of goods via an internet website that is administered by any person(s) who is a relative, family member or who normally resides with the Insured.

- Claim for compensation made with dishonest or fraudulent intention of the Insured.

- Order/Purchase of illegal goods of all kinds.

- Purchase of goods for resale.

- Objects of diamonds and precious stones, gold, furs, precious metals, diamonds or precious stones or objects decorated with such, antique, sculpture, design drawing, painting, rare objects, rare books, goods items for collection, blueprint, pattern, mold, model or prototype, gold, silver, precious metals or precious stones, and other properties of similar nature.

- Computer software, services, intangible goods, rental or rented properties.

Exclusions for Coverage (2)

- Loss or damage arising from or due to the following causes is not covered:

- Loss or damage occurs outside the period of insurance coverage.

- Loss or damage as a result of willful acts of a relative(s) of the Insured.

- Loss or damage caused by or arising from any willful act or willful and gross negligence of the Insured.

- Loss or damage as a result of or in connection with the business activities, operations or occupation of the Insured.

- Willful act or false declaration, acts of dishonesty, criminal acts, malicious or fraudulent acts by the Insured or relative(s) of the Insured including family member(s) or any acts known to the Insured or relative(s) in concealing information or material facts relating to this insurance policy.

- Loss of or damage to goods which is lost or stolen from a vehicle.

- Loss of or damage to goods arising from leakage, loss of weight, shrinkage, evaporation or contamination, damage from moth or vermin or animals such as rodents, insects, termite, deterioration, rust, fungi, or gradual deterioration.

- Loss or damage caused by breakdown of machinery, breakdown of electrical system, breakdown of computer program, breakdown of database system, including interruption of power system or electricity system, interference wave, shortage or electricity supply, blackout, or interruption of communication system or satellite.

- Loss of or damage to goods due to normal wear and tear.

- Loss of or damage to goods caused by alteration including cutting, sawing, reshaping.

- Loss of damage to goods left without care in public places.

- Loss of or damage to goods arising from theft without any trace and unable to prove the cause.

B) Loss of or damage to property as follows is not covered:

- Goods with a value of less than 3,000 Baht.

- Cash or cash equivalent, traveler’s check, all kinds of tickets, promissory note, check or stamps, coins, money order, debt instrument, securities or negotiable instruments such as gift certificate, pre-paid card, gift voucher or gift check.

- Objects of diamonds and precious stones, gold, furs, precious metals, diamonds or precious stones or objects decorated with such, antique, sculpture, design drawing, painting, rare objects, rare books, goods items for collection, blueprint, pattern, mold, model or prototype, gold, silver, precious metals or precious stones, and other properties of similar nature.

- Second-hand goods, reproduced goods, goods altered at the time of purchase.

- Live animals or plants, edible goods, spoilable goods, services.

- Vehicles including motor vehicle, boat, airplane and equipment, tools, spare parts which are necessary for their operation and maintenance.

- Rented goods or goods for rent.

- Goods which are personal property that the Insured carries along during a personal trip.

- Goods which have been permanently installed within a household or office including carpet, floor, tiles, air conditioner, refrigerator and heater.

- Goods purchased for resale or for trading business.

Conditions for Claim Payment

The Insured must make purchase via an internet website and make payment by credit card via online payment gateway.

- The Insured does not receive the purchased goods or receives goods different from the purchase agreement within the period of 30 days from the date on which purchase and payment are completed.

- The Insured must provide all relevant documents to support the claim.

- The Insured will be compensated maximum not exceeding the Limit of Coverage or the purchase amount paid by the Insured by credit card, whichever lesser.

- Consideration of claim will be proceeded after receiving a letter of the vendor denying to compensate for the damage.

Documents Required for Claim Indemnification

- A completed standard Claim Form of MSIG Insurance (Thailand) Public Company Limited.

- Document or evidence of payment for the online purchase.

- Document on Order Confirmation from the vendor and evidence of communications with the vendor to follow up delivery, request compensation on damage or request for refund but all being denied by the vendor (if any).

- A copy of the Police Report/Register certified by the case officer.

- Other document or evidence as may be necessarily required by the Company.

For more information

MSIG Customer Service Center 0 2007 9045

Available on Monday – Friday 08:30 – 21:00, Saturday 09:00 – 18:00

(Except Sunday and Public Holidays)

Claim Service

Claim Center Hotline 1259 (available 24 hrs.)

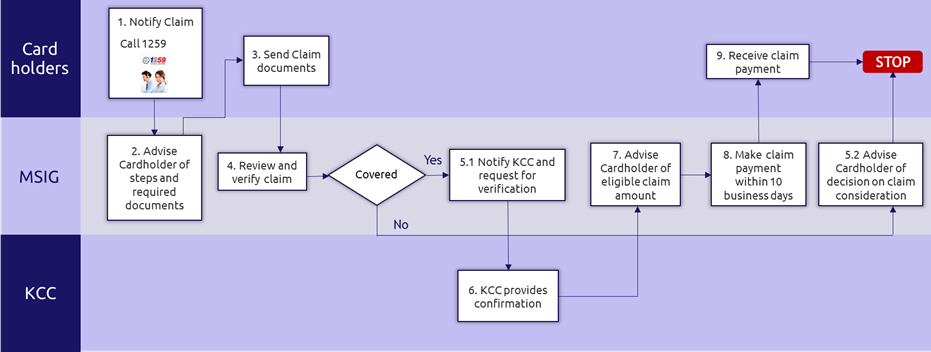

Claim Handling Process and Procedure